Ready for Growth, the Chinese Beauty Market Requires Overseas Brands to Understand Nuance

Time: January 18, 2024 By WWD

WWD, JANUARY 17, 2024

“CP” initiator and digital-driven platform S'YOUNG International discusses the state of the Chinese beauty market and what brands must know when considering the opportunity.

As beauty brands across the globe consider the potential for new areas of growth, S'YOUNG International, the beauty brand management company and digital-driven open platform for global brands, remains steadfast in its belief that there is ample opportunity to enter the Chinese market.

Previously reported by WWD Beauty Inc, China has already become key to growth for global beauty companies, driven by rising household incomes, new entrants and the increasing development of local brands. Reports have shown an increasing customer base for beauty and skincare products in China as a result of not only rising household incomes but also the increasing consumption power of lower-tier cities and the rise of independent Chinese brands.

Over the last decade, over 5,000 foreign cosmetic brands have entered the Chinese market where they have seen continuous growth and contributed to the Chinese beauty industry value chain becoming more sophisticated.

Four Key Differences to Consider for Overseas Brands

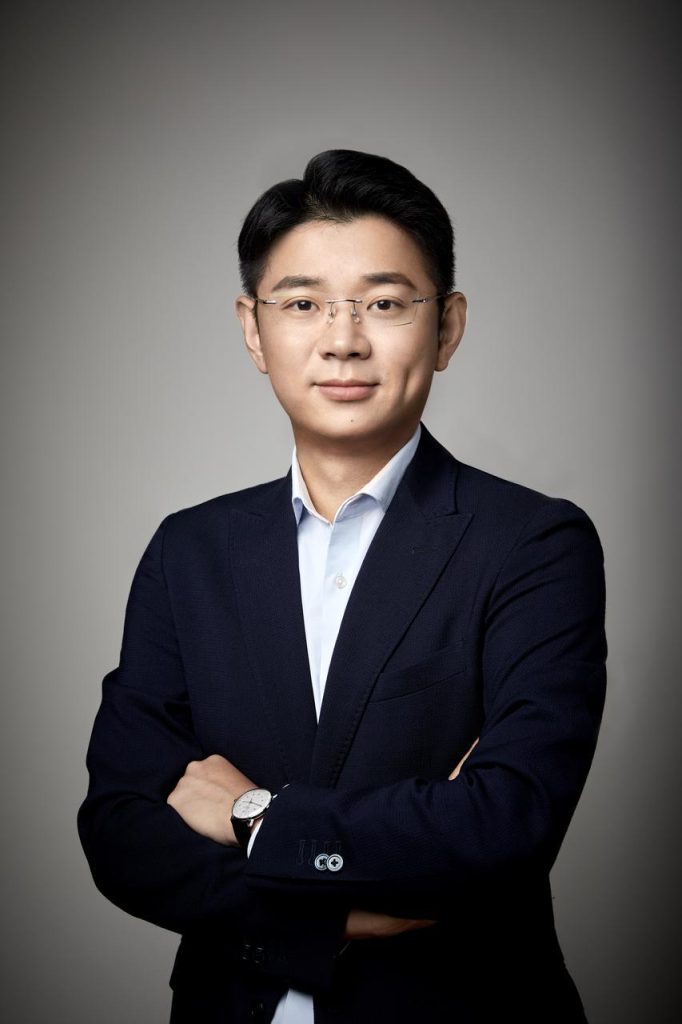

According to Marshall Chen, co-founder and chief executive officer of S'YOUNG International, China's beauty market is booming and can be mainly divided into three parts including local Chinese brands, overseas established groups and niche overseas brands.

“For those overseas established names like L'Oréal and Estée Lauder, they already have clear positionings for the Chinese market and have achieved notable success in past years,” said Marshall. “We also noticed the niche overseas brand part is growing, although it is currently in third place.”

Even more nuanced though is the Chinese beauty market consumer, how they shop and what their needs are. And with this in mind, Marshall said, brands need to be careful to consider four key differences in the Chinese market before they can do serious business in China. These differences include not only the Chinese consumer but also differences in channels, marketing and regulations.

Consumers Differ Among Cities and Generations

Consumers are quite different from city to city and generations. China has a population of over 1.4 billion and people born in different generations present characteristic consumption features.

“In China, most of Gen Y have a steady income and they tend to fulfill their basic demands with big groups like Estée Lauder or L'Oréal,” said Marshall. “But Gen Z is typically more open to a variety of options including new and niche brands to seek personalization. This is a fundamental difference between generations of consumers.”

E-commerce Leads the Way

Still, across all generations, e-commerce remains the most popular way to shop for Chinese consumers representing the leading channel in China with a high rate of engagement.

According to eMarketer, China's online retail transactions reached more than 710 million digital buyers with transactions reaching $2.29 trillion in 2020 and forecasts to reach $3.56 trillion by 2024. A report released during the 2023 China International Fair for Trade in Services (CIFTIS) also pointed out that China ranked first in global B2C e-commerce turnover in 2022 (37.2 percent), followed by the U.S. (24.4 percent).

For niche overseas brands, over 80 percent of transactions are completed through e-commerce channels. Comparatively, Marshall said, the Chinese market or Chinese consumers can quickly adapt to various models for e-commerce including B2C platforms and C2C platforms that could push a higher transaction rate.

Gen Z Pursues Diversity on Social Media

At the same time, social media is fulfilling Gen Z's demand for diversity. According to Marshall, Chinese consumers favor social media shopping and transactions is happening across social media platforms, such as Douyin and Little Red Book. Driven by personalized consumption, Gen Z consumers in China tend to explore brands through social media, to look for diverse content to help understand brands and products. Social media's embrace of extensive content caters to Gen Z's request, creating a synergy for them as consumers. With this in mind, S'YOUNG encourages brands to strategically and effectively amplify efforts in brand communication on those key platforms.

China's Regulations

A key difference that must be addressed when entering the Chinese market is a strict list of regulations on ingredients with some being prohibited and limited or requiring certifications and testing. And these regulations change. The China National Medical Products Administration (NMPA) used to request animal testing for already registered products but at present, this is no longer needed. Instead, brands are requested to provide more certifications for raw materials. Marshall noted that this adjustment is favorable for overseas brands, making it easier for them to enter the Chinese market.

Respect for Brand Stories

With many legacy brands already owning established relationships with the Chinese beauty consumer, Marshall said, brands entering the market for the first time will be challenged when breaking the ice with target audiences. Considering these comparisons, S'YOUNG helps brands find an appropriate positioning as the first step, leveraging brands' original story as the best asset to distinguish brands in the competitive market.

The CP Difference

Positioned as a “CP” (China Partner) for overseas beauty brands, S'YOUNG International provides a complete solution for brands. What this means, explained Marshall, is that “S'YOUNG International is a highly digitized brand management company that aims to be a reliable strategic China partner for cooperating brands, going beyond the role of sale-driven only company.”

Under the “CP” Model, S'YOUNG formulated a particular pattern called “139N” for branding establishment, which means “1 DNA, 3 Asset keywords, 9 Factual dimensions and N content forms.”

During the initial stages of partnerships, S'YOUNG International will clarify very clearly the DNA and the three key assets of the brand and all branding activities are centered around the “1 DNA” and “3 Asset keywords” to enhance brand awareness and resonate brands' stories with consumers, influencer/KOL and channel partners. The “9 Factual dimensions” include founders' background, brands' visuals, history, core raw materials, technology and other angles available to diversify the “N content” and touch points with consumers.

Marshall emphasized that one belief S'YOUNG International sticks to is that branding building and respect for brands' founding concept are always the most important things for business.

Marketing in China Means Sales Globally

S'YOUNG also holds a concept called “Marketing in China, Sales Globally,” which means building up awareness in China to boost global businesses. Specifically speaking, successful marketing and increasing popularity in the Chinese market help brands, especially niche brands with low awareness in their birthplace, attract global attention, drive organic exposure from media and influencers worldwide and thereby elevate brands' global brand visibility, industry recognition and transactions.

Looking to the future, S'YOUNG has confidence that the Chinese beauty market will become the marketing center as well as an innovation hub for many overseas beauty brands. Due to the intense market competition in China, Marshall explained that overseas brands in the Chinese market are not only competing but also learning and getting inspired from each other. This landscape requires brands' continuous efforts to expand the consumer base, understanding new consumers

and striving for larger market shares with innovative technology and products.

S'YOUNG International Empowers Beauty Brands to Thrive in the Complicated and Dynamic Chinese Market

With a unique and innovative model, Marshall Chen, co-founder and chief executive officer of S'YOUNG International, shares the company's commitment to being the best China Partner for both niche and established overseas beauty brands entering the Chinese market.

Fairchild Studio: What is the differentiation of S'YOUNG International in working with brand partners?

Marshall Chen: We position S'YOUNG International in a model called the “CP” Model, or China Partner. We initiated the “CP” model with the intention to provide omni channels and all dimensions of a full life-cycle service for our partners. It's a big difference from the existing “partner” models in the market.

Our partnership with brands starts with an overall analysis. S'YOUNG customizes the strategies for brands to include all crucial dimensions of target consumers, branding, product, marketing, channels and more, based on brands' actual needs, goals, their growth stage and the whole market picture.

By maintaining ongoing partnerships, we continuously analyze brands' lifecycle stages and adapt development strategies to unlock growth potential. Throughout their journey, S'YOUNG acts as a constant companion, stretching its capabilities to support partners facing challenges.

For example, during Pier Auge's cash flow squeeze, we held joint discussions to explore a deeper partnership model. This involved a multifaceted approach, including a one-time purchase of Pier Auge's Chinese business, minority stake acquisition, commitment to long-term purchasing, and advance payments on specific orders.

While these efforts might not completely solve the situation, they demonstrate S'YOUNG's unwavering commitment as a China partner to support brands through difficult times.

S'YOUNG understands its strengths: unparalleled expertise in navigating the Chinese market. We recognize the inherent uniqueness of global niche brands. Therefore, our CP model combines meticulous market management with profound collaboration to empower these brands and achieve mutually beneficial growth.

Fairchild Studio: Can you walk us through how S'YOUNG assists overseas brands in effective brand management and communication with their target audience and creating strategies for creating impressive brand stories and communicating them with target audiences in segmented markets?

Marshall Chen: S'YOUNG has consistently emphasized that “doing branding is important.” In terms of brand management, we adhere to the 139N asset management system for the repositioning and strategic guidance of brands. Lumene from Finland and Fenty Beauty from the United States are two successful promotional cases.

Lumene originates from the extreme polar environment of Finland, it incorporates distinctly Nordic natural ingredients tailored to Nordic people and lifestyles. Based on this background, we finalized the brand's fundamental DNA as “a Nordic natural beauty brand” and the three key asset keywords as “polar naturals, Nordic philosophy and Finnish national brand.” Then we further explored the specific content and suitable channels that can be leveraged.

The introduction of Nordic nature ingredients like the cloudberry, betula alba juice, Nordic people and lifestyle stories are all good assets to support the brand's DNA. In terms of channels, we crafted as many as possible touch points with consumers to enhance the message. One step is that we opened the Tmall official flagship store for Lumene, which is not a very common practice for brands. Consumers can have an immersive online shopping experience with Nordic elements including music, images and client service.

Upon consumers receive their parcel from online purchases, they will find a Nordic postmark and remarks showcasing the branding messages on the package that reads, “We sustainably bring the power of wild Nordic nature to help everyone achieve their own idea of beautiful.” and inside the package, there is card saying “It is a gift from polar Finland delivered to you across 7,000 kilometers.” This meticulously crafted design not only orchestrates a delightful unboxing experience for consumers but also serves to fortify the distinctive selling propositions of Lumene ‘s Nordic natural skincare products. It introduces a narrative layer, infusing the entire shopping process with a profound sense of storytelling and emotional resonance.

Another example is Fenty Beauty. Fenty Beauty is a relatively new brand in China and to amplify the brand's awareness, we recently initiated cross-border business for Fenty Beauty on Douyin through the Douyin overseas flagship store during the New York Fashion Week 2023.

We collaborated with the top KOL Nico, who boasts over 1.8 million followers on Douyin. She was a former Hollywood celebrity agent, trendsetting fashion influencer, and advocator for female empowerment. Her background perfectly aligns with the brand's values of confidence, inclusivity, boldness, and individuality.

We invited her to join the New York Fashion Week, utilizing vlog short videos to immerse fans in a first-person experience of Fenty Beauty's fashion-forward DNA. The brand specially invited Rihanna's makeup artist to customize an exclusive show makeup for the KOL, while also featuring Rihanna's makeup tutorial. Through her camera, Chinese consumers well understood the brand's expertise in the beauty industry, Fenty Beauty's brand identity and product features.

The entire event generated a cumulative exposure of 40 million on Douyin and Fenty Beauty secured the top 1 on Douyin's cross-border beauty industry store ranking on the first day of the fashion week.

Fairchild Studio: How does S'YOUNG select influencers that align with the brand's tone and DNA?

Marshall Chen: We have a self-developed influencer management system, an integrated digital platform developed under S'Young's strategy of empowering brands with research and development and empowering organizations with digitalization. It assists in the improvement of production efficiency from the full dimensions of branding, products, marketing, channels and operations.

The system currently owns a database of over 250,000 influencers. It can analyze KOLs' tags, background, expertise, follower base, influence regions and cooperation records, etc. Along with the 139N pattern and brand-specific needs, we can spot the most suitable influencers for brands based on the effective information in the system.

From screening to data monitoring and influence analysis, all information needed is consolidated within one management system. More importantly, the data, especially influencers' collaboration data provided by this system, is highly accurate.

This data-driven approach supports precise influencer selection and marketing strategy, establishing a complete data collection chain for the accumulation of brand digital assets.

Fairchild Studio: What do you think every brand needs to know when considering entering the Chinese market?

Marshall Chen: Generally speaking, we would suggest six “essential dos and don'ts” for brands entering the Chinese market.

For what brands should not overlook, the first is “don't underestimate the competition.” The market is vast, but numerous verticals/categories are already saturated, in a competitive “red ocean” status. Brands cannot presume that sales will certainly be favorable.

Secondly, “don't mix different consumers.” Consumers in different tiers of cities exhibit distinct preferences; therefore, it's essential not to mix them.

The third is “don't simply copy the previous experience of the success.” Many brands were very successful in their local market, but the success is based on that local environment. China is a brand-new environment so a brand cannot simply duplicate previous practices.

The first of the “dos” is “do start with wants.” That means thinking about the consumers' demands – what products they want and how to design the brand to fit those needs. While there are many products in the market that fulfill basic needs, there is still significant room for brands to cater to personalization, especially needs from the younger generation and scenario-based requests. That's their starting point.

The second “do” is “do branding.” Brands need to find the right position at an early stage to better lead the following delivery of brands' core values. For S'Young, we use “139N” to position brands before any marketing activities, and this system exists throughout the branding management and communication with consumers. The last is “do build a brand like raising a child.” Branding cannot be built in one day, and we are committed to partnering with our brands in the long run and achieving long-term success in the Chinese market.